Invest in Kumamoto, Japan’s silicon hub.

Japan will invest 10 trillion Yen ($65 billion USD) in chips and AI by 2030.

TSMC is building multiple plants in Kumamoto with government support.

Kumamoto is emerging as a key semiconductor hub.

Projected target returns

Investment highlights

Target returns

15-20% Projected rental income increase

15-20% Projected capital gain

8-10% Projected average return per year

Past performance is not a guarantee of future results.

Why Kumamoto?

Water resources

Kumamoto’s clean groundwater from Mount Aso supports water-intensive chip production. TSMC is working with locals to manage and recharge supplies.

Electricity supply

Kumamoto uses a mix of thermal and solar power, with strong solar potential and subsidies that support high-energy industries.

Housing demand

The chip industry is driving job growth and rental demand, supporting stable returns for property investors.

The MoreHarvest approach

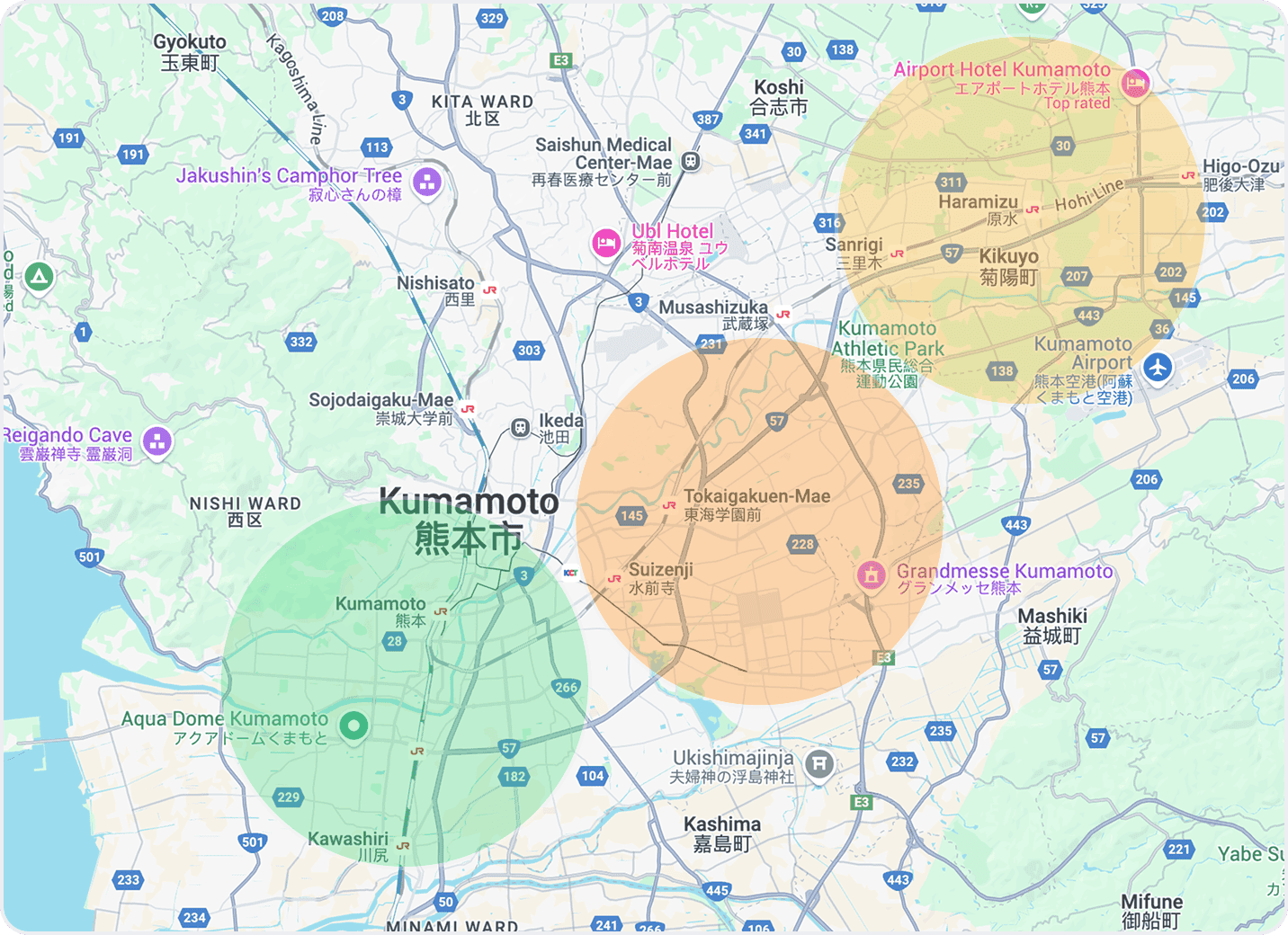

Location

TSMC area: Targets high-income semiconductor professionals.

Middle zone: Suits mid-to-upper-class office workers.

Central city: Attracts top earners from major Japanese firms.

Demand

TSMC Graduate Salaries: ¥280,000–¥360,000 plus bonuses and performance pay.

Pay is 40% above local averages and 27% above the national graduate average (2022), exceeding Sony Semiconductor.

Design

Our reinforced concrete buildings offer elevators, spacious 1LDK layouts, and smart design.

These features stand out in the market and attract well-paid new residents.

Development allocation

New RC building projects

MoreHarvest is developing reinforced concrete (RC) buildings in Kumamoto to meet demand from high-income professionals in the growing semiconductor industry. These modern, spacious properties with elevators are ideal for premium tenants.

Why build new?

Full control over design, quality, and operations.

Less impact from building age = better long-term value.

Higher appeal and stability in local demand.

Existing property renovation

MoreHarvest is also renovating existing wooden buildings by upgrading exteriors, improving durability and appearance, and modernizing interiors and common areas.

Challenges

Unstable property supply.

Renovation delays can impact rental income.

Limited design flexibility vs. new builds.

Frequently Asked Questions

What is the Kumamoto plan's strategy for renovating existing buildings versus developing new housing, and how is the product mix planned?

Most buildings in Kumamoto are wooden, but with Japan’s ¥10 trillion semiconductor push, rental prices could still rise 20%. New RC elevator-equipped buildings are rare, while well-located properties offer renovation potential.

New RC: 70%

Renovated: 30%How does MoreHarvest secure high-potential off-market properties in prime locations?

MoreHarvest sources quality properties through local partnerships—banks, brokers, management firms, construction companies, and 20 years of Japan-based networks.

What are the average timelines for renovation vs. new construction, and are local approvals needed?

Land acquisition and building permits typically take 6–12 months and require approval from the local community or relevant authorities. Construction takes about 5–6 months for wooden structures and 12 months for RC buildings. Renovation projects, unless involving major structural or usage changes, usually do not require such approvals and have a shorter construction period of around 3 months.

What risks could affect the Kumamoto strategy, and are operating permits a challenge?

Key risks in the Kumamoto strategy include:

- Land acquisition timing: Low devaluation risk due to focus on high-growth areas.

- Construction costs: Managed through local contractors and long-term pricing partnerships.

- Tenant recruitment: Handled by trusted local agencies, with conservative initial rents to minimize vacancy.

- Sale timing: RC properties under 10 years old hold value; exit is considered around year 5 based on market conditions.

What is MoreHarvest’s exit strategy—selling individual assets or exiting as a portfolio?

The MoreHarvest team will decide based on experience and market conditions. For example, if there are 10 buildings in a portfolio and a good offer comes in for one, it may be sold individually to optimize the overall portfolio and increase returns.

Got anymore questions?

12F-5, No.189, Section 2, Keelung Rd. Xinyi District, Taipei City, Taiwan 110.

Designed in Taipei, Taiwan